Keystone Private Wealth

Truly independent wealth management with solutions for families, businesses and not for profits

Independence lies at the heart of all we do.

WHY?

As part of the Keystone Private Family group, our tailored advice provides a strategically coordinated approach across all investment types and asset classes.

We believe Family Offices as a group of investors tend to outperform other investment groups over the long term due to our:

- Buy side independence

- Allocation to all asset classes

- Economies of scale which equate to lower transaction, management, and operational costs

- Focus on capital preservation

- Rational open minded investment thinking

- Long term view

- Access to deal flow

- Co-ordination across the entire wealth management landscape

The world of family office wealth management is complex and subject to a multitude of influences. Standard asset allocation, model portfolios, approved product lists, platforms and funds under management-based fee structures simply do not, and cannot address individual, client-specific vagaries.

There is no one size fits all solution. Independence is paramount.

What is independence to Keystone Private Wealth?

- Retainer based fees, no referral fees, and no commissions

- Access to best of breed market participants in all asset classes

- Transparent structures and reporting

“Keystone Private Wealth clients should experience feelings of trust, integrity, and confidence that their best interest is being served.”

HOW?

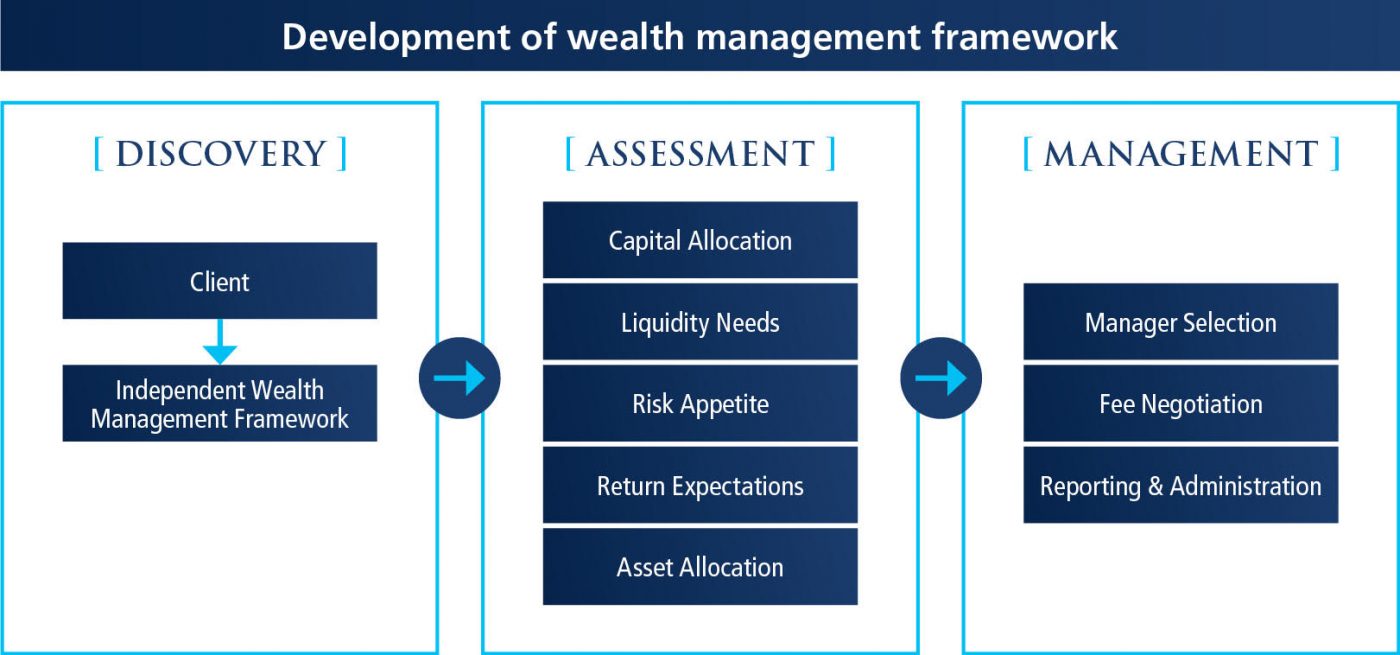

Our expert, independent wealth management and investment consulting services create a wealth management framework:

Portfolio Reporting and Administration

- Interpreting, analysing and consolidating the myriad of reports available from your various investment managers is not only daunting but near impossible without significant investment in time and resources.

- Keystone Private Wealth works from source documentation to provide user friendly, consistent, and comparable information across asset classes, managers, entities and on a consolidated basis. Our reporting will represent a reliable, independent, single source of truth in a format that suits your needs.

- We can provide comparative reporting showing the performance of managers, not only within your own portfolio but against other managers and portfolios within our investment universe.

Deal Flow and Due Diligence

- Given our network of high net wealth clients, brokers, managers and other industry participants, we have exposure to opportunities and deal flow across all asset classes not readily available to most.

- Our clients have access to off market transactions, co-investment, club, and syndicate investments outside of traditional investment platforms.

- With the significant experience of our team and extensive network of investment professionals, we can also assist with the due diligence needs associated with your investment activities.

Open Advisory Panel

We believe the traditional composition of advisory panels and investment committees utilised by other investment groups is outdated and counterproductive to ensuring the broadest advice and knowledge base is available to our clients.

We think outside of traditional methodologies and to demonstrate this we developed an Open Advisory Panel concept.

Our clients have access to 100s of experts with 1000s of years’ experience. Professionals in every field of expertise that can add value to decisions within your investment and wealth management journey.

Keystone Private Wealth Team

Proudly Supporting our Community